Can You Draw Unemployment if You Drive Uber

No driver wants to be idle. You enjoy being out, meeting passengers, serving them… and making good money in the process. Unfortunately, that's just not our reality right now. The coronavirus (COVID-19) crisis has made the highly social, and lucrative, occupation of rideshare and delivery driving almost impossible.

With most travel at a standstill, social distancing the new normal, and stay-at-home orders fast becoming our way of life, your car is parked and your income has taken a drastic nosedive. Delivery drivers are impacted too, even though there's still business from restaurants open for takeout only.

Last March, when the pandemic was first declared, none of us had any idea what to expect. Of course, we all hoped the crisis would be short-lived—yet here we are, almost a year later, with no end in sight.

For drivers, this is the worst possible scenario. In most states the economy hasn't recovered; there are no bustling bars or restaurants, the airports are quiet, and hotels are nearly empty. Even office buildings, once surefire sites for passenger pickups, remain comparatively idle, if not empty.

Because of this lack of activity, it's still pretty hard to rely on rideshare driving to make a living.

So what can you do?

Until April of 2020, drivers, as independent contractors, might have (rightly) believed they were out of luck when it came to getting unemployment compensation. In fact, there's been a lot of back and forth between some drivers and rideshare and delivery platform companies involving the impact of drivers not being actual, hired employees.

After the coronavirus crisis hit, things changed drastically. Last April, the federal government stepped up to help states with the expenses of unemployment through the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Within this bill are provisions for independent contractors, including drivers, to collect unemployment compensation.

The CARES Act was slated to expire on December 26, 2020, but recent events have allowed its benefits to continue—at least for now.

In this article, we'll answer some of the most common questions about unemployment compensation and other benefits for drivers, including:

- Do I qualify for unemployment?

- How much will I get?

- How do I file?

- Filling out the application

- For how long will benefits be extended?

What we know, and what we don't

We want to give you as much information as possible here, but because this is all so new, much of the process you need to go through to secure unemployment compensation is still in flux.

Remember, we're not legislators or lawyers – but we are here for you, and doing the best we can to share the information we discover as our research comes in. We can't guarantee anything for you, but we can definitely offer some guidance and advice.

Now, let's get down to the nitty gritty.

Do I qualify for unemployment?

The answer is, if you're a driver for Uber, Lyft, GrubHub, Postmates, or another driving or delivery service, and you're an independent contractor – yes. You didn't qualify before the CARES Act was enacted, but you do now.

The Ways and Means Committee of the United States House of Representatives puts it this way:

"Expanded eligibility would provide benefits to self-employed individuals, independent contractors, "gig economy" employees, and individuals who were unable to start a new job or contract due to the pandemic. Individuals would apply for these temporary new federal benefits at the state UC office, and states would be fully reimbursed for the cost of benefits and administration."

Under the CARES Act, you will self-qualify. This means you will attest to the fact your income has been drastically reduced as a result of the COVID-19 pandemic.

Do keep in mind that you are going to have the best chance of getting your application accepted if your driving job is your chief source of income. If, for example, you have a regular job, can continue to work from home and get paid, but have lost the income from the driving job you had as a side-gig, you may not qualify. However, that doesn't mean you can't apply.

When in doubt, go ahead and apply.

How much will I get?

One of the hardest things about answering this and many other questions is that unemployment compensation varies widely from state to state. You will need to adjust your expectations to what your state has to offer, except for one thing.

Any independent contractor who qualifies for unemployment compensation will receive $300 per week, which will be funded by the federal government. This is over and above anything you might receive from the state. From the Ways and Means Committee again:

"Through July 31, 2020, the federal government would provide a temporary Federal Pandemic Unemployment Compensation (FPUC) of $300 a week for any worker eligible for state or federal unemployment compensation (UC) benefits. The FPUC would be paid in addition to and at the same time (but not necessarily in the same check) as regular state or federal UC benefits. The FPUC, combined with the underlying state unemployment benefit, would replace 100 percent of wages for the average U.S. worker…"

As you can see, this compensation is much better than the kick in the teeth you came to expect as an Independent Contractor before all this happened. Even if your state doesn't give you a lot of money, you will still have that $300 per week.

This money will still come through your state unemployment compensation program, though, so you will still have to apply with your state to get it, plus any other benefits you may have coming your way.

How Do I File?

Filing for unemployment compensation isn't as difficult or complicated as people often think. In many cases, you can apply online. Or, you may be able to file at your local unemployment office, but be sure to check the website to confirm their hours of operation. You may also have the option of applying by phone if you have lots of questions or just want to talk to someone.

Our advice is: Check your state website (information is below) and follow the given instructions.

Your first step is to find information about the status of your state's unemployment program and how to apply. Find your state's information below.

If your state's information is not listed below, or you need more information you can use this handy Unemployment Benefits Finder that can link you to the website for your state.

Who is eligible for unemployment?

Alabama unemployment benefits are available to any individual who has lost their work through no fault of their own as a result of COVID19. Eligibility now includes being unable to work due to illness of COVID19, quarantine or isolation due to the disease, caring for an immediate family member who has been diagnosed with COVID19, or reduced hours as a result of social distancing measures.

This includes rideshare drivers.

What benefits are rideshare drivers eligible for?

Drivers in Alabama are eligible for up to $275 per week for up to 20 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is Alabama currently accepting unemployment applications for rideshare and delivery drivers?

Drivers in Alabama can apply for unemployment via the Alabama state unemployment website. However, be sure to have your previous year 1099s and tax return info ready.

We have seen many accounts of drivers receiving benefits in Alabama.

We recommend rideshare and delivery drivers in Alabama apply now to receive unemployment benefits.

How can rideshare drivers file?

Who is eligible for unemployment?

Alaska unemployment benefits are available to any individual who has lost their work through no fault of their own as a result of COVID19. Eligibility now includes being unable to work due to illness of COVID19, quarantine or isolation due to the disease, caring for a family member who has been diagnosed with COVID19, or reduced hours as a result of social distancing measures.

This includes rideshare drivers.

Is Alaska currently accepting unemployment applications for rideshare and delivery drivers?

Drivers in Alaska appear to be able to apply for unemployment via the Alaska state unemployment website. However, be sure to have your previous year 1099s and tax return info ready.

We have not seen any accounts of drivers in Alaska receiving benefits yet, however, the state website does say drivers can now apply.

We recommend rideshare and delivery drivers in Alaska apply now to receive unemployment benefits.

What benefits are rideshare drivers eligible for?

Drivers in Alaska are eligible for up to $370 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

How can rideshare drivers file?

Who is eligible for unemployment?

Arizona unemployment benefits are available to any individual who has lost their work through no fault of their own as a result of COVID19. Eligibility now includes being unable to work due to illness of COVID19, quarantine or isolation due to the disease, caring for a family member who has been diagnosed with COVID19, or reduced hours as a result of social distancing measures.

This includes rideshare drivers!

What benefits are rideshare drivers eligible for?

Drivers in Alaska are eligible for up to $240 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is Arizona currently accepting unemployment applications for rideshare and delivery drivers?

As of April 19th, 2020 The DES website says Arizonans are awaiting guidance from the U.S. Department of Labor, but they do encourage self-employed people to apply right now.

Federal Emergency Management Agency says Arizona hasn't been approved for unemployment assistance for self-employed people and the president would need to sign off on it, which hasn't happened yet. We've seen rideshare drivers getting denied and getting approved. So based on the state of Arizona's guidance, I would recommend applying.

Drivers in Arizona can apply for unemployment via the Arizona state unemployment website. However, be sure to have your previous year 1099s and tax return info ready.

We have seen many accounts of drivers receiving benefits in Arizona.

We recommend rideshare and delivery drivers in Arizona apply now to receive unemployment benefits.

How can rideshare drivers file?

Who is eligible for unemployment?

Arkansas unemployment benefits are available to any individual who has lost their work through no fault of their own as a result of COVID19. Eligibility now includes being unable to work due to illness of COVID19, quarantine or isolation due to the disease, caring for a family member who has been diagnosed with COVID19, or reduced hours as a result of social distancing measures.

This includes rideshare drivers!

What benefits are rideshare drivers eligible for?

Drivers in Arkansas are eligible for up to $450 per week for up to 16 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is Arkansas currently accepting unemployment applications for rideshare and delivery drivers?

Drivers in Arkansas can apply for unemployment via the Arkansas state unemployment website. However, be sure to have your previous year 1099s and tax return info ready.

We have not seen accounts of drivers receiving benefits yet in Arkansas, however, the state is encouraging everyone to apply. We recommend rideshare and delivery drivers in Arkansas apply now to receive unemployment benefits.

How can rideshare drivers file?

Who is eligible for unemployment?

California unemployment benefits are available to any individual who has lost their work through no fault of their own as a result of COVID19 or ha their hours decreased due to COVID-19.

Some people are eligible if providing care for a ill family member with COVID-19.

This includes rideshare drivers.

What benefits are rideshare drivers eligible for?

Drivers in California are eligible for up to $450 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is California currently accepting unemployment applications for rideshare and delivery drivers?

Drivers in California can apply for unemployment via the California state unemployment website. However, be sure to have your previous year 1099s and tax return info ready.

We have seen many accounts of drivers receiving benefits yet in California, so we recommend rideshare and delivery drivers in California apply now to receive unemployment benefits.

How can rideshare drivers file?

Who is eligible for unemployment?

Colorado unemployment benefits are available to any individual who has lost their work through no fault of their own as a result of COVID19 or has had their hours reduced.

This includes rideshare drivers.

Drivers are also eligible to receive $600 per week in benefits as well.

What benefits are rideshare drivers eligible for?

Drivers in Colorado are eligible for up to $618 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is California currently accepting unemployment applications for rideshare and delivery drivers?

Drivers in Colorado can apply for unemployment via the Colorado state unemployment website. However, be sure to have your previous year 1099s and tax return info ready.

We have seen many accounts of drivers receiving benefits yet in Colorado, so we recommend rideshare and delivery drivers in Colorado apply now to receive unemployment benefits.

How can rideshare drivers file?

Who is eligible for unemployment?

Connecticut unemployment benefits are available to any individual who has lost their work or had their hours drastically decreased through no fault of their own as a result of COVID19.

This includes rideshare drivers!

What benefits are rideshare drivers eligible for?

Drivers in Connecticut are eligible for up to $649 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is Connecticut currently accepting unemployment applications for rideshare and delivery drivers?

Drivers in Connecticut can apply for unemployment via the Connecticut state unemployment website. However, be sure to have your previous year 1099s and tax return info ready.

We have seen many accounts of drivers receiving benefits yet in Connecticut, so we recommend rideshare and delivery drivers in Connecticut apply now to receive unemployment benefits.

How can rideshare drivers file?

Who is eligible for unemployment?

Delaware unemployment benefits are available to any individual who has lost their work through no fault of their own as a result of COVID19. Eligibility now includes being unable to work due to illness of COVID19, quarantine or isolation due to the disease, caring for a family member who has been diagnosed with COVID19, or reduced hours as a result of social distancing measures.

This includes rideshare drivers!

What benefits are rideshare drivers eligible for?

Drivers in Delaware are eligible for up to $400 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in benefits as well.

Is Delaware currently accepting unemployment applications for rideshare and delivery drivers?

Drivers inDelaware can apply for unemployment via theConnecticut state unemployment website. However, be sure to have your previous year 1099s and tax return info ready.

We have not seen any accounts of drivers in Delware receiving benefits, but it does appear that the state is encouraging anyone self employed to file.

How can rideshare drivers file?

Who is eligible for unemployment?

Individuals in the District of Columbia who have become temporarily or permanently unemployed due to COVID-19, have been placed under quarantine, or cannot work because they are caring for a family member sick with COVID-19 are eligible for unemployment benefits under the Pandemic Unemployment Program.

This does include rideshare and delivery drivers.

What benefits are rideshare and delivery drivers eligible for?

Drivers in the District of Columbia are eligible for up to $444 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is D.C. currently accepting unemployment applications for rideshare and delivery drivers?

Drivers in D.C. can apply for unemployment via the D.C. unemployment website. We have seen many accounts of drivers receiving benefits in D.C.

We recommend rideshare and delivery drivers in D.C. apply now to receive unemployment benefits.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

Florida unemployment benefits are available to any individual who has lost their work through no fault of their own as a result of COVID19. Eligibility also includes being unable to work due to illness of COVID19, quarantine or isolation due to the disease, caring for a family member who has been diagnosed with COVID19, or reduced hours as a result of social distancing measures.

This includes rideshare drivers!

What benefits are rideshare drivers eligible for?

Drivers in Florida are eligible for up to $275 per week for up to 12 weeks.

Drivers are also eligible to receive $600 per week in benefits as well.

Is Florida currently accepting unemployment applications for rideshare and delivery drivers?

Drivers inFlorida can apply for unemployment via theFlorida state unemployment website. However, be sure to have your previous year 1099s and tax return info ready.

We have seen many accounts of drivers receiving benefits yet inFlorida, so we recommend rideshare and delivery drivers inFlorida apply now to receive unemployment benefits.

How can rideshare drivers file?

Who is eligible for unemployment?

Georgia unemployment benefits are available to any individual who has lost their work through no fault of their own as a result of COVID19, which would include rideshare drivers.

What benefits are rideshare drivers eligible for?

Drivers in Georgia are eligible for up to $365 per week for up to 20 weeks.

Drivers are also eligible to receive $600 per week in benefits as well.

Is Georgia currently accepting unemployment applications for rideshare and delivery drivers?

Drivers inGeorgia can apply for unemployment via theGeorgia state unemployment website. However, be sure to have your previous year 1099s and tax return info ready.

We have seen many accounts of drivers receiving benefits yet inGeorgia, so we recommend rideshare and delivery drivers inGeorgia apply now to receive unemployment benefits.

How can rideshare drivers file?

Who is eligible for unemployment?

Unemployment benefits in Hawaii have been extended to anyone who has lost their employment due to COVID-19 and anyone unable to work due to being ill or quarantied. Anyone who needs to care for a sick family member can apply for benefits under the Hawaii Family Leave law.

What benefits are rideshare drivers eligible for?

Drivers in Delaware are eligible for up to $648 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in benefits as well.

Is Hawaii currently accepting unemployment applications for rideshare drivers?

As of April 19th, 2019 Hawaii's unemployment website has not been updated. Their website states the following:

"UI benefits for self-employed persons and bona fide independent contractors are covered through the Pandemic Unemployment Assistance (PUA) program under THE CARES Act. The DLIR is working on putting together a new web-based system to efficiently operate the program. Until the DLIR can launch the new portal, please hold off trying to file for benefits, certify claims, or address denials or disqualifications at this time."

Based on the above statement, we recommend waiting to file unemployment as a driver in Hawaii.

How can rideshare drivers file?

Who is eligible for unemployment?

Individuals in Idaho whose employment has been negatively affected by COVID19 may be eligible for UI. This includes those that have had their hours reduced due to COVID-19 or are ill themselves.

What benefits are rideshare drivers eligible for?

Drivers in Idaho are eligible for up to $448 per week for up to 20 weeks.

Drivers are also eligible to receive $600 per week in benefits as well.

Is Idaho currently accepting unemployment applications for rideshare drivers?

As of April 19th, 2019 Idaho does appear to be accepting applications for rideshare drivers, however, we have had no reports of successful applications thus far. We recommend drivers attempt to call to apply.

How can rideshare drivers file?

Who is eligible for unemployment?

Individuals in Illinois who have become temporarily or permanetly unemployed to to COVID-19, are caring for a family member, or have been diagnosed with COVID-19, or have been quarantined by the government due to COVID-19 are eligible for unemployment benefits.

What benefits are rideshare drivers eligible for?

Drivers in Illinois are eligible for up to $484 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is Illinois currently accepting unemployment applications for rideshare drivers?

Illinois does appear to be accepting applications for drivers. However, the state of Illinois does not expect to be able to send checks to drivers until the week of May 11th.

How can rideshare drivers file?

Who is eligible for unemployment?

Individuals in Indiana who have become temporarily or permanently unemployed to to COVID-19, are caring for a family member, or have been diagnosed with COVID-19, or have been quarantined by the government due to COVID-19 are eligible for unemployment benefits.

What benefits are rideshare drivers eligible for?

Drivers in Indiana are eligible for up to $390 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is Indiana currently accepting unemployment applications for rideshare drivers?

As of April 19th, 2020, it does not appear that Indiana's state website is accepting applications from gig-drivers. See a statement from their website below:

"As Congress passed the COVID-19 CARES ACT, a major component is the temporary $600 weekly increase and special provisions for self-employed and independent contractor unemployed workers. While plans are being put into place to get the additional relief to impacted Hoosier workers as soon as possible, we are awaiting federal guidance to implement the programs. As soon as the final determinations are made, we will post the information on this page and Unemployment.IN.gov."

Given this information, drivers in Indiana will likely need to wait until the state sets up their portal to file.

How can rideshare drivers file?

Who is eligible for unemployment?

Individuals in Iowa who have become temporarily or permanently unemployed due to COVID-19, are caring for a family member infected with COVID-19, have been diagnosed with COVID-19, or have been quarantined by the government due to COVID-19 are eligible for unemployment benefits.

What benefits are rideshare drivers eligible for?

Drivers in Iowa are eligible for up to $481 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is Iowa currently accepting unemployment applications for rideshare drivers?

The state of Iowa is accepting unemployment applications for rideshare drivers and we have seen first hand accounts of drivers receiving benefits. Drivers are encouraged to apply as soon as possible.

How can rideshare drivers file?

Who is eligible for unemployment?

Individuals in Kansas who have become temporarily or permanently unemployed to to COVID-19 are eligible for unemployment benefits. It is unclear whether or not individuals who have sick family members qualify for unemployment assistance.

What benefits are rideshare drivers eligible for?

Drivers in Kansas are eligible for up to $488 per week for up to 16 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is Kansas currently accepting unemployment applications for rideshare and delivery drivers?

As of April 19th, 2020, it does not appear that the Kansas state website is accepting applications from gig-drivers. See a statement from their website below:

Important Notice: The CARES Act has been signed into law to provide an additional $600 to eligible recipients of unemployment insurance and a benefit to those not traditionally eligible for unemployment insurance such as self-employed workers, independent contractors, etc. We have begun the process of implementing these vital programs; however, these benefits are not yet available. You will be notified once these benefits are available.

Given this information, drivers in Kansas will likely need to wait until the state sets up their portal to file.

How can rideshare drivers file?

Who is eligible for unemployment?

Individuals in Kentucky who have become temporarily or permanently unemployed to to COVID-19 are eligible for unemployment benefits. It is unclear whether or not individuals who have sick family members qualify for unemployment assistance.

What benefits are rideshare drivers eligible for?

Drivers in Kentucky are eligible for up to $552 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is Kansas currently accepting unemployment applications for rideshare and delivery drivers?

Information about if Kentucky is accepting applications at the moment is scarce for Kentucky and we have not come across any accounts of drivers receiving benefits.

Given this information, drivers in Kentucky may need to wait to file, however, we would enourage drivers to call the Kentucky unemployment office for more details.

How can rideshare drivers file?

Who is eligible for unemployment?

Individuals in Louisiana who have become temporarily or permanently unemployed to to COVID-19 are eligible for unemployment benefits. It is unclear whether or not individuals who have sick family members qualify for unemployment assistance.

This does include rideshare and delivery drivers.

What benefits are rideshare and delivery drivers eligible for?

Drivers in Louisiana are eligible for up to $247 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is Kansas currently accepting unemployment applications for rideshare and delivery drivers?

It does appear that the state of Louisiana is accepting unemployment applications for rideshare drivers and we have seen multiple drivers get approved. We recommend applying as soon as possible.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

Individuals who are not eligible for UI, EB or PEUC, including self- employed people and those who have exhausted other programs, and whose income has been reduced by the COVID-19.

This includes Rideshare and Delivery Drivers.

What benefits are rideshare drivers eligible for?

The maximum amount of unemployment in Maine is $378 per week for up to 39 weeks. Your payment is calculated according to several factors. You will also receive $600 per week from the federal government, retroactively to April 4th, and extending through July 31st.

Is Maine currently accepting unemployment applications for rideshare drivers?

Maine will accept applications for Pandemic Unemployment Assistance (PUA) starting May 1, 2020.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

Individuals in Maryland who have become temporarily or permanently unemployed to to COVID-19 are eligible for unemployment benefits. It is unclear whether or not individuals who have sick family members qualify for unemployment assistance.

This does include rideshare and delivery drivers.

What benefits are rideshare and delivery drivers eligible for?

Drivers in Maryland are eligible for up to $430 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is Maryland currently accepting unemployment applications for rideshare and delivery drivers?

It does appear that the state of Maryland is accepting unemployment applications for rideshare drivers and we have seen multiple drivers get approved. We recommend applying as soon as possible.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

Individuals in Massachusetts who have become temporarily or permanently unemployed due to COVID-19, are caring for a family member infected with COVID-19, have been diagnosed with COVID-19, or have been quarantined by the government due to COVID-19 are eligible for unemployment benefits.

This does include rideshare and delivery drivers.

What benefits are rideshare and delivery drivers eligible for?

Drivers in Massachusetts are eligible for up to $823 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is Massachusetts currently accepting unemployment applications for rideshare and delivery drivers?

It does appear that the state of Massachusetts is accepting unemployment applications for rideshare drivers and we have seen multiple drivers get approved. We recommend applying as soon as possible.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

Individuals in Michigan who have become temporarily or permanently unemployed to to COVID-19 are eligible for unemployment benefits. Individuals that must leave a job to care for a family member who has contracted COVID-19 and individuals that have been quarantined also qualify.

This does include rideshare and delivery drivers.

What benefits are rideshare and delivery drivers eligible for?

Drivers in Michigan are eligible for up to $362 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is Michigan currently accepting unemployment applications for rideshare and delivery drivers?

The Michigan state unemployment website says drivers will be able to apply for unemployment under the Pandemic Unemployment Program starting April 20th, 2020. We recommend drivers applying on the 20th.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

Individuals in Minnesota who have become temporarily or permanently unemployed to to COVID-19 are eligible for unemployment benefits. Individuals that must leave a job to care for a family member who has contracted COVID-19 and individuals that cannot come to their workplace because of possible COVID-19 exposure also qualify.

This does include rideshare and delivery drivers.

What benefits are rideshare and delivery drivers eligible for?

Drivers in Minnesota are eligible for up to $740 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is Minnesota currently accepting unemployment applications for rideshare and delivery drivers?

The Minnesota state unemployment website says drivers and other self employed individuals are able to apply for unemployment under the Pandemic Unemployment Program now. We recommend drivers apply as soon as possible.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

You are eligible for Pandemic Unemployment Assistance (PUA) in Mississippi if your work hours and income are reduced due to COVID-19 and you are not eligible for other forms of unemployment assistance.

What benefits are rideshare drivers eligible for?

Benefits can be up to a maximum of $235 per week, for up to 39 weeks, plus the $600 per week offered by the federal government.

Is Mississippi currently accepting applications for Unemployment?

Mississippi does seem to be accepting unemployment applications from drivers at this time.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

Individuals in Missouri who have become temporarily or permanently unemployed to to COVID-19 are eligible for unemployment benefits. Individuals that must leave a job to care for a family member who has contracted COVID-19 and individuals that are under mandatory or self-quarantine also qualify.

This does include rideshare and delivery drivers.

What benefits are rideshare and delivery drivers eligible for?

Drivers in Missouri are eligible for up to $320 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is Missouri currently accepting unemployment applications for rideshare and delivery drivers?

It does appear that drivers in Missouri can apply for unemployment under the Pandemic Unemployment Program now. However, we have not found any reports of drivers successfully applying and receiving benefits yet. We recommend drivers apply as soon as possible.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

You are eligible for Pandemic Unemployment Assistance (PUA) in Montana if your hours and income have been reduced by the COVID-19 outbreak, and you're not eligible for standard unemployment compensation or other programs.

This includes rideshare and delivery drivers.

What benefits are rideshare drivers eligible for?

Benefits can be up to a maximum of $552 per week, for up to 39 weeks, plus the $600 per week offered by the federal government.

Is Montana currently accepting applications for Unemployment?

Montana is fully capable of receiving PUA applications at this time.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

Nebraska accepts your unemployment claim if your hours and income have been reduced by the COVID-19 outbreak, and you're not eligible for standard unemployment compensation or other programs.

This includes rideshare and delivery drivers.

What benefits are rideshare drivers eligible for?

Benefits can be up to a maximum of $440 per week for up to 39 weeks, plus the $600 per week offered by the federal government.

Is Nebraska currently accepting applications for Unemployment?

Nebraska is accepting PUA applications at this time, but the application goes through the general website.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

Individuals in Nevada who have become temporarily or permanently unemployed to to COVID-19 are eligible for unemployment benefits.

This does include rideshare and delivery drivers.

What benefits are rideshare and delivery drivers eligible for?

Drivers in Nevada are eligible for up to $469 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is Nevada currently accepting unemployment applications for rideshare and delivery drivers?

It does appear that drivers in Nevada can apply for unemployment under the Pandemic Unemployment Program now. However, we have not found any reports of drivers successfully applying and receiving benefits yet. We recommend drivers apply as soon as possible.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

New Hampshire will accept your unemployment claim as a self-employed person. You will have to apply once, get rejected, and ask for a second review. At that time, you should receive state compansation

This applies to rideshare and delivery drivers.

What benefits are rideshare drivers eligible for?

The maximum from the state is $427 per week, for up to 39 weeks, plus the $600 per week offered by the federal government.

Is New Hampshire currently accepting applications for Unemployment?

New Hampshire is accepting applications through the regular website. No separate website for Pandemic Unemployment Assistance (PUA) is available at this time.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

Individuals in New Jersey who have become temporarily or permanently unemployed due to COVID-19, have been diagnosed with COVID-19 or have symptoms, are self-quarantining due to COVID-19, or are caring with a family member ill with COVID-19 are eligible for unemployment benefits.

This does include rideshare and delivery drivers.

What benefits are rideshare and delivery drivers eligible for?

Drivers in New Jersey are eligible for up to $713 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is New Jersey currently accepting unemployment applications for rideshare and delivery drivers?

It does appear that drivers in New Jersey can apply for unemployment under the Pandemic Unemployment Program now. We recommend drivers apply as soon as possible.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

You are eligible to apply for Pandemic Unemployment Assistance (PUA) if your income has been substantially reduced by the COVID-19 outbreak, and you are not eligible for other programs.

As a rideshare or delivery driver, you would qualify.

What benefits are rideshare drivers eligible for?

Benefits can be up to a maximum of $397 per week, for up to 39 weeks, plus the $600 per week offered by the federal government.

Is New Mexico currently accepting applications for Unemployment?

Yes. You must, however, first apply for regular unemployment. When your application is rejected by this system, a link to the site needed to apply to PUA will appear.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

Individuals in New York who have become temporarily or permanently unemployed due to COVID-19, have been diagnosed with COVID-19 or have symptoms, are self-quarantining due to COVID-19, or are caring with a family member ill with COVID-19 are eligible for unemployment benefits.

This does include rideshare and delivery drivers.

What benefits are rideshare and delivery drivers eligible for?

Drivers in New York are eligible for up to $504 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is New York currently accepting unemployment applications for rideshare and delivery drivers?

It does appear that drivers in New York can apply for unemployment under the Pandemic Unemployment Program now. We have found multiple reports of drivers successfully applying and receiving benefits. We recommend drivers apply as soon as possible.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

Individuals in North Carolina who have become temporarily or permanently unemployed due to COVID-19, have been diagnosed with COVID-19 or have symptoms, are self-quarantining due to COVID-19, or are caring with a family member ill with COVID-19 are eligible for unemployment benefits under the Pandemic Unemployment Program.

This does include rideshare and delivery drivers.

What benefits are rideshare and delivery drivers eligible for?

Drivers in North Carolina are eligible for up to $350 per week for up to 12 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is North Carolina currently accepting unemployment applications for rideshare and delivery drivers?

The unemployment website for the state of North Carolina is not currently setup to accept applications from drivers or anyone that is self employed. The state website says their website will be updated on the 25th of April. We recommend waiting until the April 25th to apply.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

As long as you're not eligible for regular unemployment or other compensation programs, you can apply as a gig worker for Pandemic Unemployment Assistance (PUA)

This includes rideshare and delivery drivers!

What benefits are rideshare drivers eligible for?

Benefits can be up to a maximum of $618 per week, for up to 39 weeks, plus the $600 per week offered by the federal government.

Is North Dakota currently accepting applications for Unemployment?

Yes. On the main page, there is a green b

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

Individuals in Ohio who have become temporarily or permanently unemployed due to COVID-19, have been diagnosed with COVID-19 or have symptoms, or self-quarantining due to COVID-19 are eligible for unemployment benefits under the Pandemic Unemployment Program.

This does include rideshare and delivery drivers.

What benefits are rideshare and delivery drivers eligible for?

Drivers in Ohio are eligible for up to $480 per week for up to 20 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is Ohio currently accepting unemployment applications for rideshare and delivery drivers?

The unemployment website for the state of Ohio is not currently setup to accept applications from drivers or anyone that is self employed. The state says drivers and anyone that is self employed will need to wait until the May to apply. We recommend waiting until the state website is ready to apply.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

Individuals in Oklahoma who have become temporarily or permanently unemployed due to COVID-19 are eligible for unemployment benefits under the Pandemic Unemployment Program.

This does include rideshare and delivery drivers.

What benefits are rideshare and delivery drivers eligible for?

Drivers in Oklahoma are eligible for up to $539 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is Oklahoma currently accepting unemployment applications for rideshare and delivery drivers?

Drivers in Oklahoma can apply for unemployment via the Oklahoma state unemployment website, but must have income verification documents such as 1099s or tax returns from last year. This process is still difficult for most drivers, so be prepared with all necessary documents and be persistent. We recommend rideshare and delivery drivers in Oklahoma apply now to receive unemployment benefits.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

Individuals in Oregon who have become temporarily or permanently unemployed due to COVID-19, are under mandatory or self-quarantine, or are caring for a family member diagnosed with COVID-19 are eligible for unemployment benefits under the Pandemic Unemployment Program.

This does include rideshare and delivery drivers.

What benefits are rideshare and delivery drivers eligible for?

Drivers in Oregon are eligible for up to $648 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is Oregon currently accepting unemployment applications for rideshare and delivery drivers?

Drivers in Oregon can apply for unemployment via the Oregon state unemployment website. We recommend rideshare and delivery drivers in Oregon apply now to receive unemployment benefits.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

Individuals in Pennsylvania who have become temporarily or permanently unemployed due to COVID-19 are eligible for unemployment benefits under the Pandemic Unemployment Program.

This does include rideshare and delivery drivers.

What benefits are rideshare and delivery drivers eligible for?

Drivers in Pennsylvania are eligible for up to $572 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is Pennsylvania currently accepting unemployment applications for rideshare and delivery drivers?

Drivers in Pennsylvania can apply for unemployment via the Pennsylvania state unemployment website. We recommend rideshare and delivery drivers in Pennsylvania apply now to receive unemployment benefits.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

Gig workers and other independent contractors are eligible to apply.

This includes rideshare and delivery drivers!

What benefits are rideshare drivers eligible for?

Benefits can be up to a maximum of $586 per week,for up to 39 weeks, plus the $600 per week offered by the federal government.

Is Rhode Island currently accepting applications for Unemployment?

Yes. On the main page for unemployment, there is an area to click on to get to the application for Pandemic Unemployment Assistance (PUA)

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

Gig workers and other independent contractors are eligible to apply for unemployment through the Pandemic Unemployment Assistance (PUA) program.

This includes rideshare and delivery drivers!

What benefits are rideshare drivers eligible for?

Benefits can be up to a maximum of $326 per week,for up to 39 weeks, plus the $600 per week offered by the federal government.

Is South Carolina currently accepting applications for Unemployment?

Yes. South Carolina recently launched their site for PUA applications.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

In South Dakota, "unemployment" is called "re-employment." Don't worry. It's the same idea. You are eligible if your work hours and pay have been adversely affected by the COVID-19 pandemic.

As a rideshare or delivery driver, you qualify for Pandemic Unemployment Assistance (PUD).

What benefits are rideshare drivers eligible for?

Benefits can be up to a maximum of $414 per week, for up to 39 weeks, plus the $600 per week offered by the federal government.

Is South Dakota currently accepting applications for Unemployment?

Yes. South Dakota is ready to accept PUA applications.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

Individuals in Tennessee who have become temporarily or permanently unemployed due to COVID-19, or have been quarantined by a doctor are eligible for unemployment benefits under the Pandemic Unemployment Program.

This does include rideshare and delivery drivers.

What benefits are rideshare and delivery drivers eligible for?

Drivers in Tennessee are eligible for up to $275 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is Tennessee currently accepting unemployment applications for rideshare and delivery drivers?

Drivers in Tennessee can apply for unemployment via the Tennessee state unemployment website. However, it appears the state is unsure when drivers can expect to be paid. The Tennessee state unemployment website says the following:

President Trump recently signed the CARES Act or COVID-19 stimulus bill into law. Once the Tennessee Department of Labor and Workforce Development determines how the state will obtain the federal funding and implement the changes, the Department will announce details for independent contractors, the self-employed and business owners who will soon be eligible for Pandemic Unemployment Assistance. Look for more visibility of when Tennessee will enact these changes in the next few days.

We recommend rideshare and delivery drivers in Tennessee apply now to receive unemployment benefits, however, keep an eye on the state's unemployment website to understand when you can expect payments to be made.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

Individuals in Texas who have become temporarily or permanently unemployed due to COVID-19 are eligible for unemployment benefits under the Pandemic Unemployment Program.

This does include rideshare and delivery drivers.

What benefits are rideshare and delivery drivers eligible for?

Drivers in Texas are eligible for up to $521 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is Texas currently accepting unemployment applications for rideshare and delivery drivers?

Drivers in Texas can apply for unemployment via the Texas state unemployment website. We have seen many accounts of drivers receiving benefits.

We recommend rideshare and delivery drivers in Texas apply now to receive unemployment benefits.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

Individuals in Utah who have become temporarily or permanently unemployed due to COVID-19, have been placed under quarantine, or have had their place of employment quarantined due to COVID-19 are eligible for unemployment benefits under the Pandemic Unemployment Program.

This does include rideshare and delivery drivers.

What benefits are rideshare and delivery drivers eligible for?

Drivers in Utah are eligible for up to $580 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is Utah currently accepting unemployment applications for rideshare and delivery drivers?

Drivers in Utah can apply for unemployment via the Utah state unemployment website. We have seen many accounts of drivers receiving benefits in Utah.

We recommend rideshare and delivery drivers in Utah apply now to receive unemployment benefits.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

You qualify for unemployment if your work and your income have been severely reduced due to COVID-19.

As a rideshare or delivery driver, you qualify for Pandemic Unemployment Assistance (PUD).

What benefits are rideshare drivers eligible for?

Benefits can be up to a maximum of $513 per week for up to 39 weeks, plus the $600 per week offered by the federal government.

Is Vermont currently accepting applications for Unemployment?

Yes. Vermont's online application for PUA is up and running. However, you must first apply for regular unemployment, and wait for an email inviting you to apply for PUA benefits.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

Individuals in Virginia who have become temporarily or permanently unemployed due to COVID-19, have been placed under quarantine, or cannot work because they are caring for a family member sick with COVID-19 are eligible for unemployment benefits under the Pandemic Unemployment Program.

This does include rideshare and delivery drivers.

What benefits are rideshare and delivery drivers eligible for?

Drivers in Virginia are eligible for up to $378 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is Virginia currently accepting unemployment applications for rideshare and delivery drivers?

Drivers in Virginia can apply for unemployment via the Virginia state unemployment website. We have seen many accounts of drivers receiving benefits in Virginia.

We recommend rideshare and delivery drivers in Virginia apply now to receive unemployment benefits.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

Individuals in Washington who have become temporarily or permanently unemployed due to COVID-19, have been placed under quarantine, or cannot work because they are caring for a family member sick with COVID-19 are eligible for unemployment benefits under the Pandemic Unemployment Program.

This does include rideshare and delivery drivers.

What benefits are rideshare and delivery drivers eligible for?

Drivers in Virginia are eligible for up to $790 per week for up to 26 weeks.

Drivers are also eligible to receive $600 per week in federal benefits as well.

Is Washington currently accepting unemployment applications for rideshare and delivery drivers?

Drivers in Washington can apply for unemployment via the Washington state unemployment website. We have seen many accounts of drivers receiving benefits in Washington.

We recommend rideshare and delivery drivers in Washington apply now to receive unemployment benefits.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

In West Virginia, you're eligible for Pandemic Unemployment Assistance (PUA) if you do not qualify for regular unemployment assistance, and your work hours have been reduced or removed due to the COVID-19 pandemic.

As a rideshare or delivery driver, you qualify.

What benefits are rideshare drivers eligible for?

Benefits can be up to a maximum of $424 per week for up to 39 weeks, plus the $600 per week offered by the federal government.

Is West Virginia currently accepting applications for Unemployment?

Yes. West Virginia is prepared to accept applications for PUA.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

In Wisconsin, you are eligible for Pandemic Unemployment Insurance as long as you are not collecting other unemployment compensation, and have suffered a loss of income due to the COVID-19 outbreak.

Rideshare and delivery drivers qualify!

What benefits are rideshare drivers eligible for?

Benefits can be up to a maximum of $370 per week for up to 39 weeks, plus the $600 per week offered by the federal government.

Is Wisconsin currently accepting applications for Unemployment?

Yes. Wisconsin has an online application for PUA available.

How can rideshare and delivery drivers file?

Who is eligible for unemployment?

In Wisconsin, you are eligible for Pandemic Unemployment Insurance as long as you are not collecting other unemployment compensation, and have suffered a loss of income due to the COVID-19 outbreak.

Rideshare and delivery drivers qualify!

What benefits are rideshare drivers eligible for?

Benefits can be up to a maximum of $508 per week for up to 39 weeks, plus the $600 per week offered by the federal government.

Is Wyoming currently accepting applications for Unemployment?

While Wyoming is accepting regular unemployment claims, PUA claims are not yet being accepted. The application is estimated to be available by May 1. Look for update here:

http://wyomingworkforce.org

How can rideshare and delivery drivers file?

Once you've found your state's website…

You'll need some items on hand before you sit down to fill out the application. You'll find most of the information from your personal records and the tax records supplied by the companies you drive for. You might have to search for some of the other information, depending on what you need. Wherever we can, we'll provide a few tidbits right here.

Here's what you'll want to have handy:

- Your Social Security number, date of birth, and all your personal contact information such as complete address, phone number(s), and email address.

- Your banking information. If you choose to use direct deposit, you'll need to provide your bank's routing number and your account number. These numbers are printed on the bottom of your checks; if you don't have checks, you may be able to get the numbers from your bank.

- Your employer's address and telephone number. Note: The best way to obtain the address and phone number for other driving and delivery companies is to do a web search on "(Your Company) corporate address." For a variety of reasons, this information isn't always easy to find on the company websites. Here's the information for Uber and Lyft.

UBER

182 Howard Street, Suite 8

San Francisco, CA 94105 USA

(415) 986-2104

LYFT

185 Berry Street, Suite 5000

San Francisco, CA 94107

(855) 865-9553

- Your employment information for the last 18 months to two years. This includes the start and end dates of your job(s).

- Information about any other work that you do, especially as a self-employed contractor. Make sure that rideshare or delivery is the majority of your income before applying as a driver. If, for instance, you also work as a consultant, and you make more money doing that than driving, and you're no longer able to operate that business, you'll need to apply for unemployment under that job.

If, however, you have a business that could be considered a side line, it won't affect your collecting unemployment compensation as a driver.

- Proof of authorization to work in the United States, if you're not a U.S. citizen. You must have a Social Security number, however, as those with Individual Taxpayer Identification Numbers cannot collect unemployment benefits.

- In many cases, your driver's license or state I.D. card number.

Filling out the application

Each state has a different format for its application, but one thing remains consistent in all of them: You must be totally transparent and honest about the information you put on the application. No one wants you to be called out for unemployment fraud–but that is exactly what can happen if you try to hide income or deny that you're making money while collecting unemployment.

If you're collecting sick pay or unemployment for some other reason, you probably won't qualify to collect additional unemployment compensation. It will pay to check with your state to see what your individual situation might be.

Most of the states have generous Help sections on their websites. Some even take you through the application step by step. It's also a good idea to ask friends who've already applied and received unemployment compensation in your state if there are any nuances or quirks in the system you need to know about.

You'll need to set up an account, if you don't already have one, so the state can contact you if necessary and you can easily access your information.

Some things to remember…

You will have to answer a lot of questions about your demographics, your income, and the reason why you're filing. Be patient. It's all part of the process.

In most cases, as the reason your employer is no longer able to pay you, you'll be given the option to check: "Not enough work," or something along that line.

You may be asked if your employer gave you a possible return date. Since no one knows when business will get back to normal, there's no way to provide such a date. Don't guess here; just say "no."

You'll be given the option to receive checks or direct deposit. If you select direct deposit, you will be asked for your bank's routing number and your full account number.

What happens next?

Even though completing the application can be an arduous process, it's worth it. Once your application is complete, the unemployment compensation staff will review it, and you'll be sent money either by check or direct deposit.

You may hear back from the agency, as they could have questions about your income. As we said before, most applications are still designed to cater to salaried and hourly workers. There will have to be a different evaluation process for independent contractors, so they're likely to have questions for you.

One question might involve the numbers on your past income statements, so make sure you can easily obtain these from your rideshare or delivery platform app or website–or better yet, get those statements in your hands before you file for unemployment. That will save you some time if you're asked for that information.

There usually is a waiting period of one week for unemployment compensation to begin, but under this new legislation, the waiting period has been lifted. Still, it might take at least that long to get your application processed, considering the volume they're getting hit with right now.

Do I have to look for other work?

Normally, people collecting unemployment compensation must prove that they're looking for other work while they're collecting benefits, but that is not the case with unemployment compensation under the PUA. You will, however, have to prove that you can't work due to the COVID-19 pandemic, but if you're able to do that, especially if it's for health reasons, you most likely won't be asked to look for other work.

Even though looking for work isn't required, it's always a good idea to do so because it's a fact that unemployment benefits will eventually run out. We hope the COVID crisis will end soon and rideshare business will boom once again, but no one knows when that might happen.

How much money will I get?

Like we said, it depends on your state's policies. In most cases, you'll get at least 50% of your normal income. Plus, the federal government is sweetening things with that additional $300 per week on top of normal unemployment compensation.

Also, if you haven't already, you'll get a second stimulus payment. The first payments, $600 per individual taxpayer, rolled out in January 2021. There may or may not be more to come. It will depend on how fast the economy recovers, and decisions a new Congress might make.

With all that money as a cushion, staying at home may sound like an attractive proposition.

But before you get too cozy, curled up on the couch with a bag of your favorite snacks, remember… the unemployment compensation "cushion" won't be there forever.

For how long will benefits be extended?

No one really knows how long the coronavirus crisis will last, so it's impossible to know how long independent contractors will be allowed to collect unemployment compensation. Right now, you can receive compensation for time as far back as the end of January 2020, when income began to shrink due to the pandemic.

On December 27, President Trump signed a $900 billion economic relief bill passed by Congress. The bill was designed to provide further relief to those suffering through the economic sting of COVID-19 lockdowns, and contains some stipulations that benefit gig workers who depend on unemployment compensation.

Provisions in the bill extend the PUA program, which enables independent contractors to apply for compensation, until March 14, 2021. The rules that govern your state's unemployment compensation program still apply, just as they have since the CARES Act was passed last March.

The supplemental payment of $300, provided by the federal government, is also extended through March 14, 2020—a huge relief for those who depend on the payments to stay afloat. What happens in March will depend on a number of variables, from how effective vaccines are in arresting the spread of the virus, to a new administration's way of dealing with the crisis.

Meanwhile, it's good to know drivers can feel safe about the continued flow of unemployment benefits, which kick in as of December 26, 2020. If you've had an interruption in your benefits due to the lapse of the previous programs, your payments will resume and will be retroactive back to that date.

How long it takes for this money to begin flowing again will vary depending on your state, and how quickly the feds can get the funds released. As always, you'll need to check your state's unemployment compensation website to see when funds might come to you, and what you'll need to do to make sure that happens.

At this time, if you believe you qualify, there's no reason to NOT file for unemployment, because it'll be awhile before you'll be driving people around at the pace you kept before. The unemployment compensation benefit, along with the $1,200 cash payment that most taxpayers will receive, will give you at least some relief while we continue to weather this crisis.

If you do drive

If you want to get back to driving, or switch to delivery, don't even think of taking off without going online with Gridwise. You'll get information on topics such as this one from our blog , entertaining insight from the Gridwise YouTube channel , and tons of benefits from the Perks tab. That's where you'll find great deals and discounts for drivers.

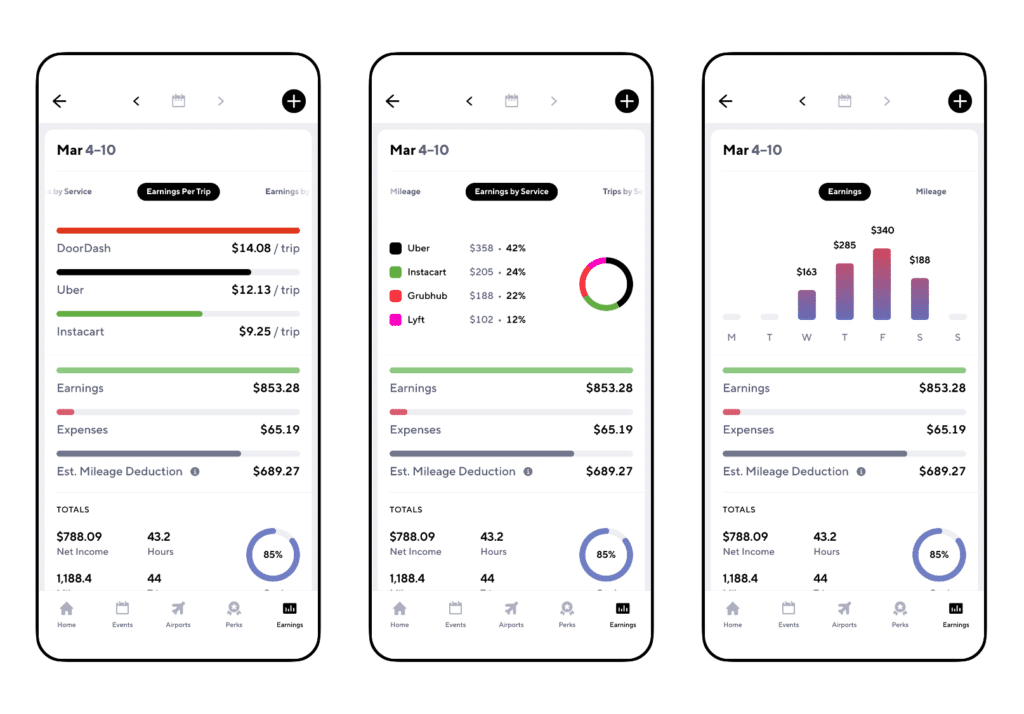

Most important,Gridwise can now automatically track your earnings as well as your mileage. Download the app, link your gig driving accounts, andGridwise will crunch the numbers, and come out with slick pictures of all the info you need, like these:

Download the app now, and you can optimize your driving time and make more money when it's safe for you to do so. Meanwhile, join us on Facebook to get a real feel for the great connections you'll find in the Gridwise driver community.

Also, don't forget to

Bonus Video: How to file for unemployment as a rideshare or delivery driver!

We have also recorded a short video to better explain how drives can file for unemployment. Check it out below!

Can You Draw Unemployment if You Drive Uber

Source: https://gridwise.io/how-rideshare-and-delivery-drivers-can-file-for-unemployment-compensation

0 Response to "Can You Draw Unemployment if You Drive Uber"

Post a Comment